What You Need to Know About Aaa Autoclub

AAA insurance: Our thoughts

Car insurance lesser line: AAA automobile insurance, in places where it's available, tends to exist affordable with good benefits and solid discounts. Drivers who already take or are interested in a membership may be able to find a good charge per unit, but yous may find a better deal elsewhere if yous're in a unlike automobile social club.

Homeowners insurance bottom line: AAA homeowners insurance is non every bit widely bachelor as AAA car insurance. Rates tend to be very competitive, particularly with bundling discounts, but it falls curt when it comes to features and benefits.

AAA Auto Clubs are independently run organizations with varying degrees of connection with one another, and then are their insurance arms. This means that the discounts, benefits and coverage options tin can vary significantly by location, and the only way to exist sure of what's available in your area is to contact your local office.

There are dozens of AAA Car Clubs throughout the United States, and many of them offer several types of insurance, including automobile, dwelling house and life insurance.

How does AAA compare to other car insurance companies?

In some places, "Triple A" merely acts as a broker, where the company collects your information and refers you to another insurer, like Progressive or Land Farm, to actually sell y'all insurance. When AAA acts as a banker, you lot even so receive discounts for beingness a AAA member. This process is specially mutual for homeowners insurance.

Nevertheless, AAA sells auto insurance directly in most places, and their policies are oft better than average in terms of cost and benefits, with well-regarded customer service and a smooth claims process.

AAA homeowners insurance, for customers who tin can become information technology, offers affordable rates only a relatively small diversity of coverage options. AAA homeowners insurance is not bachelor in equally many locations equally their automobile insurance policies, and in some places it is simply bachelor if y'all bundle information technology with auto coverage. Bundling these policies can atomic number 82 to some significant savings on both, so it'due south worth getting a quote if you're already considering AAA for your car insurance.

AAA insurance policies almost always crave you lot to be a AAA Auto Society fellow member to purchase coverage. But in exchange, AAA insurance typically offers a discount to your policy that covers or exceeds the cost of an Auto Guild membership. In this sense, you can recall of AAA Car Club membership benefits as existence part of your AAA insurance policy, as many of the benefits an AAA Auto Lodge membership provides are sometimes provided by an automobile insurance policy. For example, AAA Auto Gild members receive roadside assistance, which other insurance companies offer for an additional fee.

AAA Automobile Insurance

- What's covered under AAA machine insurance?

- AAA auto insurance discounts

- Customer Service Reviews and Ratings

Notice the Cheapest Automobile Insurance Quotes in Your Surface area

AAA machine insurance coverages and benefits

There are numerous AAA car clubs throughout the U.South., and many of them sell and provide motorcar insurance through dissimilar regional companies.

For example, drivers in Northern California, Arizona and parts of Pennsylvania, amid others, can buy insurance from the California State Auto Association (CSAA) Insurance Group. Merely AAA members in Southern California, Texas and northern New England are covered by the Auto Lodge Enterprise Group.

This ways that the exact coverages, benefits and discounts offered will vary based on your location. However, all AAA insurance agencies offer the almost common coverages, which include:

- Bodily injury and property impairment liability: Liability coverage pays for the medical care and property damage of the other party when yous are at fault in an blow.

- Collision: Standoff coverage pays for damage to your car in an accident.

- Comprehensive: Comprehensive coverage pays for noncollision damages to your auto, too as damages from a standoff with an animal.

- Uninsured/underinsured motorist: Uninsured/underinsured motorist coverage compensates you for medical and car repair costs when the other commuter is at error and does non accept adequate car insurance.

- Medical payments/personal injury protection: Medical payments and personal injury protection (PIP) coverage encompass the cost of medical care for people in your car in an accident, regardless of who is at fault.

AAA has a mobile app that provides some insurance-related features, like a digital proof of insurance in case yous're in an blow or pulled over. In some locations, you tin get an insurance quote and pay your bill through the app as well.

There are besides several noteworthy auto insurance coverages and benefits express to particular areas. Keep in mind that these are sometimes included in a standard policy or added on for an additional fee:

- Gap insurance: Should your auto be totaled, gap insurance covers the difference in cost between your auto's replacement toll and the amount yous owe on your lease or loan.

- Rental motorcar reimbursement coverage: Rental reimbursement coverage pays for a rental car while your vehicle is beingness repaired after an blow. Some providers also allow y'all to use rideshare credit instead of a rental motorcar.

- Rental car coverage: Rental machine coverage covers you if you lot harm a car you've rented.

- Nonowners insurance: Nonowners insurance provides liability coverage for people who don't own cars, if they do ever bulldoze.

- Pet coverage: Pet coverage pays for the costs of your pet's medical care if it is injured in a automobile accident.

- Accident forgiveness: Blow forgiveness keeps an blow from bumping up your insurance premium if y'all're an otherwise safe driver.

AAA auto social club membership: Required just useful

AAA agencies usually require you to be an automobile club member in club to buy insurance. In a sense, the benefits and features of a AAA automobile club membership are included in your car insurance. The marquee feature of a AAA membership is roadside assistance, which includes bound-starts, towing, emergency fuel delivery and minor roadside repairs.

AAA members also receive actress compensation when they are in an accident more than 100 miles from abode, covering the costs of a rental car, hotel room or other accommodation until they tin can continue on their trip.

AAA negotiates discounts on behalf of its members at thousands of businesses nationwide, including hotels, rental automobile companies and airlines. This tin be i of the biggest perks of AAA membership for people who travel often. If you purchase your trip through AAA, you'll be covered by AAA's travel accident insurance, which covers you for loss of life or limb in case of an accident.

AAA insurance discounts

Another advantage of choosing AAA for your car insurance is the wide range of discounts that y'all tin authorize for. These include everything from auto and home packet discounts for getting other types of insurance to incentives for customer loyalty and prophylactic driving.

Insurance package discounts at AAA

| Packet | Max auto disbelieve | Max other disbelieve |

|---|---|---|

| Auto and home | 15.7% | 20% off home |

| Motorcar and condo | 11.2% | twenty% off condo |

| Auto and renters | three.seven% | 10% off renters |

| Motorcar, abode and life | 19.four% | 20% off dwelling |

As the discounts show, there are strong incentives to consolidate your insurance at AAA, and despite the car-axial proper noun, the organization is also a reputable provider of these other types of insurance. For case, we found that AAA's life insurance offers competitive coverage in its own right.

Fifty-fifty if you aren't interested in anything other than auto insurance from AAA, there are still many other discounts to consider:

- Multi-vehicle discount: Relieve up to 27.3% when insuring ii or more vehicles.

- Select professionals/alumni associations: Save up to 7.4% for qualifying professions.

- Loyalty discount: Save up to 5.6% with at to the lowest degree one twelvemonth of continuous coverage.

- Good driver disbelieve: Relieve upwards to 20% on all coverages for safe habits.

- Verified mileage disbelieve: Save up to 19.1% (depending on vehicle'south annual mileage) for supplying current odometer readings when requested.

- Pupil away discount: Salve upwardly to 46.7% on select coverage when your driver-age student is away at school 100-plus miles from home without a vehicle.

- Commuter preparation disbelieve: Save up to 4.7% on select coverage upon completion of an approved course.

- Car club discount: Save upwards to five% if you belong to a qualifying car guild.

Does AAA offer affordable auto insurance rates?

The cost of motorcar insurance with AAA varies depending on which state y'all're in. Because AAA is really a federation of machine clubs from various states, the coverage that gets advertised as "AAA motorcar insurance" is provided through a number of land-specific insurers.

Each of these state insurers has its own underwriting process and local market conditions that will impact your quote for auto insurance. For illustrative purposes, we chose to get together quotes from California. Keep in heed that if yous live elsewhere, your rates will probable be somewhat different.

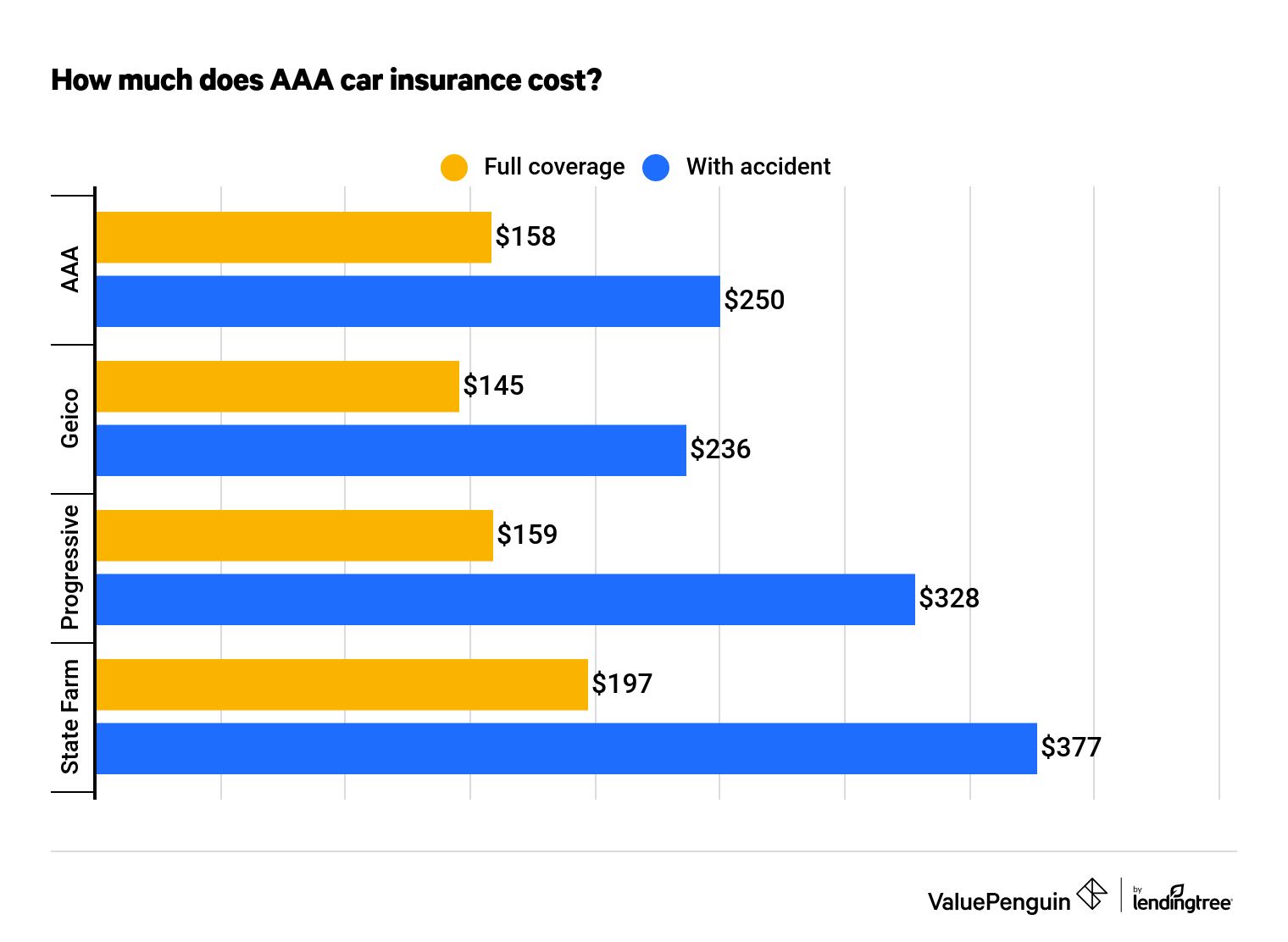

Monthly car insurance premiums in California

| Insurer | Total coverage | With accident |

|---|---|---|

| AAA | $158 | $250 |

| Geico | $145 | $236 |

| Progressive | $159 | $328 |

| State Farm | $197 | $377 |

In California, AAA's motorcar insurance rates were close to the statewide average, costing just nether $160 per month, or under $1,900 per year, for a full coverage car insurance policy. Out of the 3 other insurance companies we too looked at, only Geico returned lower rates.

If you lot are interested in comparing AAA and Geico, you lot can learn more on our AAA vs Geico comparison page.

It's also worth noting that AAA was one of the more generous insurers when it came to accidents. Both the graph and table above betoken that compared to AAA, Progressive and State Farm raised their rates far more for a driver who had at least ane recent accident on tape. This may be an advantage if you're worried about a recent incident impacting your auto insurance premium.

AAA Homeowners Insurance

- What'southward covered nether AAA abode insurance?

- AAA homeowners insurance discounts

- AAA dwelling insurance quotes: how much does it cost?

Get Quotes from Multiple Insurers At present

AAA homeowners insurance coverages

AAA homeowners insurance is not as widely available nor equally fully featured equally its auto insurance policies. As with AAA's auto insurance policies, in that location are a number of insurers that sell insurance under the AAA brand. But in general, homeowners tin expect to detect the standard coverages associated with home insurance. This includes coverage for your home's structure and roof, your personal property, and liability coverage in case someone is injured inside your home.

Some AAA house insurance providers likewise offering extended coverages for an additional fee. More frequently bachelor options include additional protection for valuables, such as jewelry and furs, umbrella insurance, coverage for living expenses if your dwelling house is uninhabitable, and insurance for natural disasters, such as earthquakes.

AAA homeowners discounts

The discounts available on homeowners insurance from AAA differ significantly across the country, simply there were a few common ways to salvage. Providers usually offer a disbelieve on your homeowners insurance premium if yous are a AAA member or purchase AAA auto insurance. Merely keep in mind that you're often required to have AAA auto insurance to purchase AAA home insurance.

Some homeowners, including those in Southern California, Texas and northern New England may notice more substantial discounts on their homeowners policies, including:

- Claim-Complimentary: Discount of up to xiii% for not making a claim for three or more years

- Protective Devices: Disbelieve of up to fifteen% for smoke detectors or a infiltrator alarm

- Retirement: 10% disbelieve if you lot are retired and 55 years old or older

- Age of Home: Discount of up to forty% depending on the age of your home (newer homes get bigger discounts)

- Dwelling Renovations: Up to 23% discount for recent renovations, such equally new pipes

- Hail-Resistant Roof: Savings of upward to 35% for a roof that is resistant to hail damage

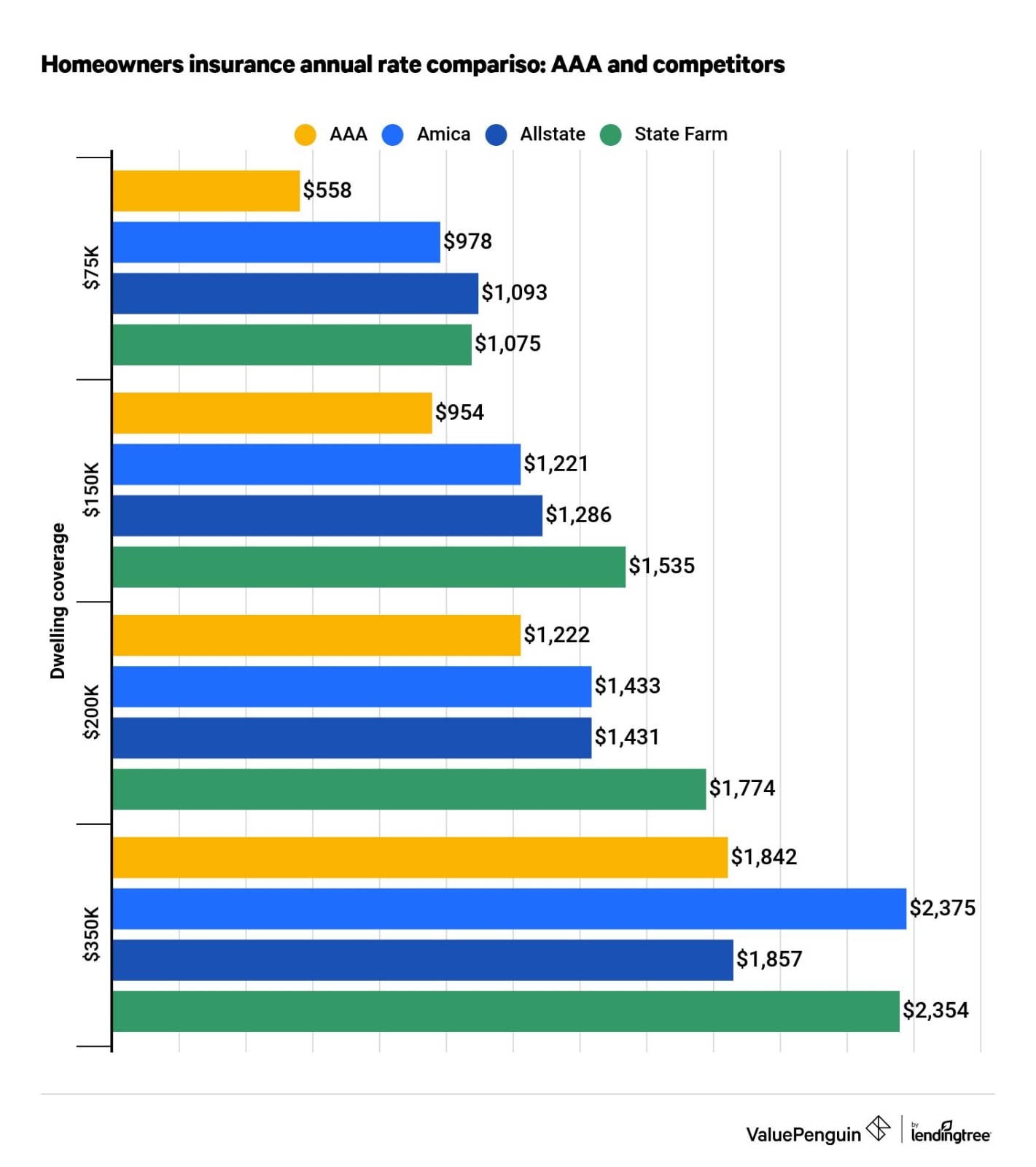

AAA homeowners insurance quote comparison

To understand what homeowners can look to pay for homeowners insurance from AAA, we collected a range of sample quotes from AAA and 3 of its competitors. Nosotros found that AAA offered excellent rates for all of our sample homes in the Austin, Texas, surface area. Homeowners with inexpensive homes stand to relieve the almost, as AAA'southward rates were 40% cheaper than boilerplate and were often the lowest rate nosotros found overall. As coverage amounts increase, the gap narrowed, but AAA was in the top two for all of the quotes nosotros gathered.

We as well did not factor in any discounts when collecting rates, then you may be able to reduce premiums even more, depending on what discounts are available in your area.

AAA Insurance Customer Service Reviews and Ratings

AAA'southward service is consistently well-rated past its customers. Information technology received a positive complaint rating of 0.55 from the National Association of Insurance Commissioners, meaning that the visitor received fewer complaints than the average company of its size. In reviews, consumers particularly note a stress-free claims process and the speedy roadside help service. However, some consumers expressed business concern over increasing premiums, besides as difficulty in the process of canceling their insurance policies.

AAA has highly reviewed financial stability, suggesting that consumers can depend on the company to pay out claims. AAA insurance agencies received ratings ranging from A+ (Superior) to A- (Excellent) from A.M. Best. These ratings bespeak a high degree of financial stability. Insurance shoppers should not worry about AAA'south ability to run into the fiscal demands of claims.

Ofttimes asked questions

Is AAA insurance affordable?

Yeah. We found that AAA's rates for auto insurance tend to be competitive with other insurers like Geico, Land Farm and Progressive. Nonetheless, keep in mind that there are dozens of split AAA auto clubs around the country, and each may use a different insurance company.

Does AAA sell homeowners insurance?

Yes. AAA sells homeowners insurance in virtually places it sells auto insurance, though its home insurance is not as widely bachelor or full-featured equally its auto coverage.

Is AAA a good insurance company?

AAA is a good insurance visitor, particularly for car insurance. Nonetheless, you are required to buy a membership to AAA in order to join, then keep that in listen before you buy a policy.

Do I demand to be a member of AAA to buy insurance?

Yes. You are required to exist a member of AAA to purchase a motorcar or home insurance policy through AAA.

Methodology

To compare the price of AAA motorcar insurance with the cost at its competitors, nosotros analyzed the company'southward statewide average rates in California for 2 drivers with full coverage: ane with a clean driving record and one with a recent at-fault blow. We collected quotes from AAA, Geico, Progressive and State Farm.

ValuePenguin's analysis used machine insurance rate information from Quadrant Information Services. These rates were publicly sourced from insurer filings and should exist used for comparative purposes merely — your own quotes may exist different.

For dwelling insurance, nosotros compared sample rates for a habitation in the Austin, Texas, area. Quotes are from AAA and three major competitors: Amica, Allstate and State Subcontract. We nerveless quotes for four different coverage levels to empathise how AAA's prices compare for homes at several cost points.

Source: https://www.valuepenguin.com/aaa-insurance-review

0 Response to "What You Need to Know About Aaa Autoclub"

Post a Comment